What’s the Difference Between ERC20 vs BEP2 vs BEP20?

Bware Labs Team

ERC20, BEP2, and BEP20 are all token standards, but each operates on a different blockchain network. Find out all the differences and which is more decentralized.

In blockchain terms, cryptocurrency and token are often used as synonymous concepts since they both represent digital assets on the blockchain. Yet, here’s the essential difference between them:

- cryptocurrencies are the native assets or native tokens of a blockchain platform (e.g., ETH is Ethereum’s native asset)

- non-native tokens are built on top of a blockchain platform, following the platform’s rules and standards

A non-native token is simply a smart contract; sending tokens means calling a method on a smart contract that someone wrote and deployed. A token contract acts like a mapping of addresses to balances, plus some methods to add and subtract from those balances.

For instance, UNI is a non-native token you have to use in Uniswap (a decentralized exchange built on Ethereum) to make transactions.

It’s essential to know the specifics of token standards because different blockchains are built for different purposes and have distinct capabilities.

For instance, sending your crypto to an address from an incompatible blockchain will stop that transaction from happening, or you can risk losing all your funds.

Let’s look at some of the most common token standards, like ERC20, BEP 2, and BEP20, and the differences between them. Plus, see how the Bware Token (BWR) fits into the picture and enables truly decentralized infrastructure.

About Token Standards

Token standards are a set of rules you need to follow to generate and implement new tokens. These standards can include a token’s minting or burning process or the supply limit, and they’re used to ensure compatibility between tokens and lack of fraud or illicit activities.

When you issue a token for a new project, this needs to be compatible with the existing decentralized exchanges, wallets, etc., or a smart contract has to allow basic functions to enable the smooth handling of transactions.

Overview: ERC20 vs. BEP2 vs. BEP20

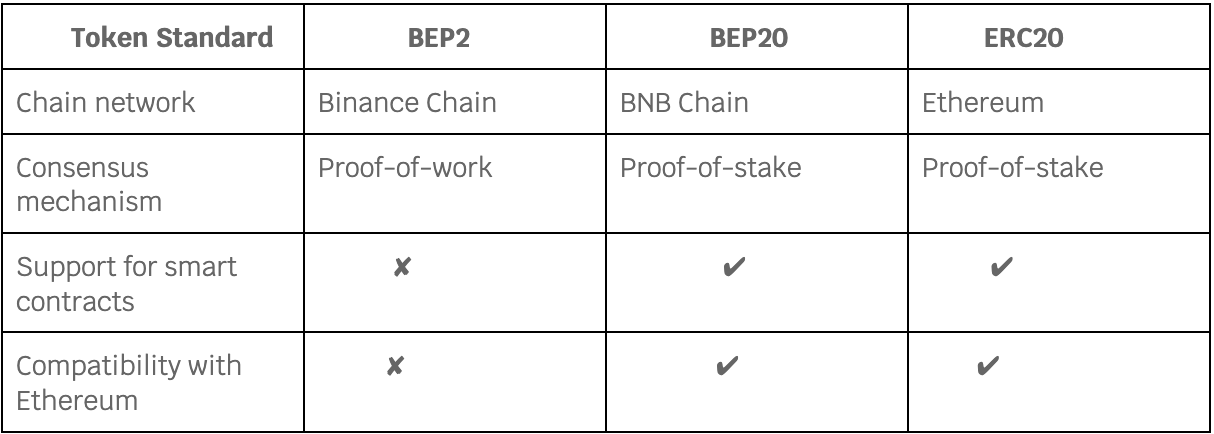

The most commonly used token standards are ERC20, BEP2, and BEP20. Here are the attributes of each one and the differences between them.

What Is ERC20?

ERC20 is the basic set of functions used by Ethereum for fungible tokens, which you can also use for trading within the Ethereum space. ERC stands for “Ethereum request for comment” and is the benchmark for creating and issuing smart contracts.

ERC20 tokens are more commonly used for utility or currency purposes.

Advantages of ERC20 tokens include:

- ease of deployment — developers can write smart contracts in Solidity, a programming language similar to JavaScript

- easy customization — you can customize ERC-20 tokens to enable features like gas auto-refill for future transactions, freezing and unfreezing a token, and adding on a central mint to modify the tokens in circulation

- wider use in blockchain communities — since its protocol is flexible, ERC20, as well as its tokens, are recognizable on most exchanges and wallets. Additionally, since you can store them in any Ethereum-compatible wallet, it’s very easy to buy, sell, exchange, or trade ERC20 tokens on cryptocurrency exchanges.

Examples of ERC20 tokens

Digital currencies like:

- Tether USD (USDT)

- USD Coin (USDC)

- Shiba Inu (SHIB)

- DAI Stablecoin (DAI)

- MAKER (MKR)

Decentralized exchanges like:

- Uniswap

- Balancer

- SushiSwap

How Is ERC20 Different from Its Equally Popular Standard — ERC721?

ERC721 tokens are also referred to as NFTs and have radically changed the concept of ownership on the blockchain. Their main application is to bring real ownership to in-game assets. Players can trade, sell or buy items with ERC721 tokens.

Unlike ERC20 tokens, ERC721 are non-fungible. That means that each ERC721 token is unique and indivisible; you can’t swap an item with another because each has unique properties.

It’s the opposite of fungible assets, where you can swap currency or shares with similar values.

What Is BEP2?

BEP2 is the token standard for the Binance chain. Essentially, this means that you need to use Binance coins to pay for gas fees to make transactions with BEP2 tokens.

BEP2 relies on proof-of-work as a consensus mechanism and presents several limitations such as:

- no support for batch transfers and smart contracts

- no support for transfers on Ethereum

- limited scalability (it doesn’t offer a clear mechanism to identify the exact number of new tokens — you need to mint or burn)

The only advantage of BEP2 tokens is that they facilitate trading between different cryptocurrencies in decentralized exchanges (DEX).

Examples of BEP2 tokens:

- Binance Coin (BNB)

- USDD

- THORChain (RUNE)

- PancakeSwap (CAKE)

- Ellipsis (EPS)

What Is BEP20?

BEP20 is the token standard for BNB Chain, which was Binance’s response to Ethereum’s increasing popularity and direct connection to dApps. In fact, BEP20 tokens were designed based on ERC20 tokens.

In a way, BEP20 is the upgraded version of the BEP2 token due to its main benefits, like:

- support for smart contracts

- compatibility with Ethereum and Ethereum Virtual Machine

- proof-of-stake as the consensus mechanism

- increased support for scalability (allows a flexible number of tokens to mint or burn to control the supply of BEP20 tokens)

- interoperability features since you can convert BEP20 tokens to BEP2 tokens.

Examples of BEP20 tokens:

- Binance USD (BUSD)

- PancakeSwap (CAKE)

- Safemoon protocol

- BUX

- C.R.E.A.M. Finance

What’s the Big Difference? Looking at Specific Tokens

What sets BEP20 and ERC20 tokens apart is that ERC20 offers unbeatable advantages such as:

- hosts a larger number of dApps

- offers a higher number of validators

- provides a higher degree of decentralization (with Ethereum ecosystem lying at the core of decentralized apps) and thus is more secure

The INFRA Token

To support blockchain project creators in building their ideas, Bware Labs will mint 100 million INFRA multichain tokens, implemented as a smart contract deployed on Ethereum network which will be released gradually over a period of over 5 years.

As a utility token, the INFRA ERC20 token will actively sustain the infrastructure economy and reliability. Participants can earn rewards through one of the following methods:

- node providers will stake tokens to join the protocol (create a new staking pool)

- users can delegate to a node provider and earn an APY

Under their Proof Of Quality concept by leveraging the Blast Integrity Protocol and scoring algorithm, tokens will be distributed to participants dependant on their overall performance.

Check all the details of our staking protocol.

Summing Up

Key things to keep in mind about token standards are:

- BEP2, BEP20, and ERC20 are the token standards used on their respective blockchains

- BEP2 has no support for smart contracts, while ERC20 is the technical standard to implement all smart contract tokens on the Ethereum blockchain

- ERC20 hosts more dApps compared to BEP20

- ERC20 tokens are also known as utility tokens; you can use them as an entry ticket to use a product or service. But utility tokens don’t have a monetary value, so their value increases along with demand.