The Bware Labs $INFRA Tokenomics

Bware Labs Team

Infra token

The following article explores the utility of the INFRA token within the Bware Labs ecosystem as well as the token distribution across multiple areas to ensure the company’s growth as well as a true revolution in the way we see Web3 infrastructure. Keep reading if you are interested in how the INFRA token fits in the Bware Labs one-stop-shop concept for infrastructure and development tools and find out why you should be part of the next-generation Web3 infrastructure movement, done the right way.

About Blast

Following two years of continuous building, and the release of Blast Mainnet earlier this year, we at Bware Labs, are moving into the next stage of decentralization by releasing INFRA, the token that will power the Blast protocol and allow us to improve the state of Web3 infrastructure. Up until Blast the Blockchain API market was either fully centralized or decentralized and lacking in performance, but now, with the listing of INFRA, all builders in the Web3 space will finally have the opportunity to make no trade-off when choosing their infrastructure provider.

Combining a state-of-the-art technical solution that allows node operators to permissionlessly register within the platform and answer requests, with a very transparent and well-designed incentivization protocol based on staking and delegations, Blast comes as a new-generation solution to the problem of Web3 infrastructure centralization.

The Role of $INFRA in the Blast Economy

INFRA will provide the base for Blast’s staking and delegation mechanism, described in detail here. With the main role of incentivizing node operators, the $INFRA token will allow Blast to achieve decentralization and become permissionless, with performance and security as the only barriers for any individual or company that wishes to join the Blast protocol and register their nodes. By doing so, INFRA will open the way for finally providing an incentive to run full nodes on the 24 supported chains, contributing to their stability, it will allow for the reallocation of unused server resources, thus reducing Web3’s overall energy consumption, it will substantially decrease infrastructure costs for builders using Blast, ultimately contributing to mass adoption for the blockchain technology and the industry.

And the best part, Blast protocol allows anyone to participate in support of a more sustainable Web3 space through a delegation mechanism designed to produce substantial yields.

The Tokenomics

Given the importance described above, the INFRA tokenomics were planned in such a way that they can ensure growth and sustainability for the Blast protocol.

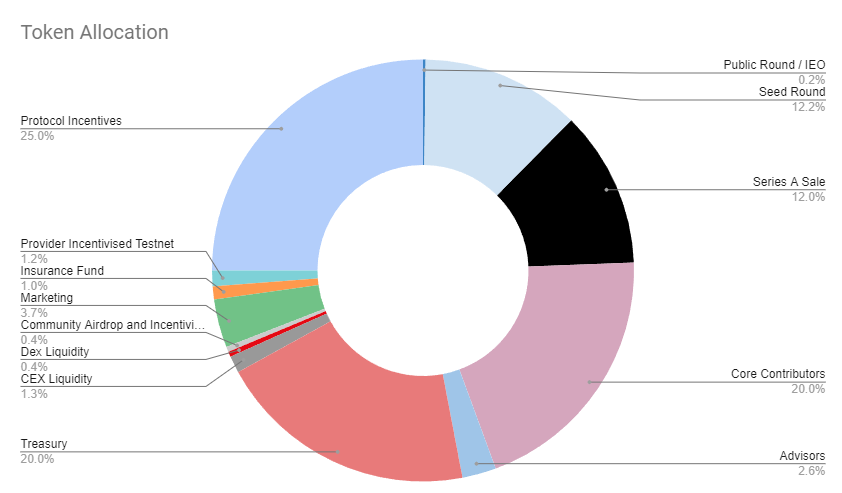

The total supply of INFRA tokens is 100M. The initial circulating supply will be 3,855,000 INFRA with an initial market cap of $1,927,500. The detailed token distribution is described below.

- Protocol Incentives: as the name suggests, the purpose of protocol incentives is to create a pool of rewards for both Node Operators as well as delegators until Blast gets enough traction to support incentives from its Subscription revenue. The way in which the subscription flow is set up, is that a configurable percentage of the total stablecoin revenue coming from Blast subscriptions goes into a treasury and is used to buy back INFRA tokens from the open market and insert them back into the protocol to serve as staking and delegation rewards. The role of the protocol incentives is to provide for a 3-year rewards runaway giving Blast enough time to gain the desired traction.

- Provider Incentivized Testnet: Before the Mainnet release in February 2023, Blast underwent a five-month testnet to validate the protocol and discover possible bugs and vulnerabilities. Blast Houston Tesnet was joined by both reputable infrastructure companies such as Figment, Republic, P2P, Infstones, Dokia Capital, and by individual node operators, all of which will be incentivized for their hard work through this section of the tokenomics.

- Marketing: Aimed at providing the required resources to build both traction and awareness around the protocol, only 15% of the marketing tokens will be unlocked at TGE for exchange marketing purposes, while the other will have a one-year cliff followed by one year and half daily vesting schedule.

- Community Aidrop and Incentivized Testnet: These are the INFRA tokens that will be airdropped to our amazing community. Whether you are a holder of one of the Galactic Motorcycle Gang NFTs or have successfully completed the Community Phase of the Houston Testnet, your efforts will be rewarded with an airdrop of fully unlocked infra tokens.

- DEX and CEX liquidity: These two sections represent the tokens that will be used to provide liquidity on both centralized and decentralized exchanges for the INFRA listing.

- Treasury: Reserved for the enhancement of the protocol, the treasury tokens will be used to incentivize the building of new and useful tools around the Blast protocol by interested third-party organizations, to increase security via Bug Bounty campaigns, and to provide delegations as incentives for Node Operators. To ensure trust, treasury tokens will have a one-year cliff and a 3 year vesting period with daily unlocks

- Core Contributors: INFRA tokens reserved for growing the Bware Labs team and development efforts. They will be used to provide the necessary incentives and motivation for the employees to provide their best results and help us bring Blast at the top of the industry. You can think of this section as the equivalent of equity options in big tech companies. The vesting schedule for the “Core Contributors” tokens spans over four years, with one year cliff and three years daily linear vesting.

- Seed round investors: The seed round investors were the ones that believed in Bware Labs since it was just an idea and a free-to-use proof of concept and even so, they are subject to a pretty strict vesting schedule of 2.5 years. All investors will have a cliff of one year followed by 1.5 years of daily linear vesting

- Series A investors: The series A investors are the ones that helped us scale and build Blast in what it is today. Raising a Series A helped us go through the bear market up to this point where Bware Labs is self-sustainable.

- Public round: Although we will not be trying to raise any funds via a public sale, there will be a series of campaigns together with our exchanges which will represent different opportunities for our community to obtain INFRA tokens even if they are not qualified for the airdrop.

- Advisors: Whether by providing valuable insights and feedback, helping us to define business strategies, or by enabling connections and various introductions, we wouldn’t be here without our advisors’ help and this section of the tokenomics is reserved to reward that effort. All the advisors will have the same vesting schedule as the Seed and Series A investors.

Conclusion

Bware Labs’ mission is to boost Web3 adoption through fast, reliable infrastructure and development tooling solutions. The $INFRA token represents a major milestone in the decentralization of our flagship product, Blast which is intended to disrupt and improve the Web3 infrastructure market with a higher quality product at an unbeatable price. But we won’t stop here, for the next couple of months, we will be coming up with a series of enhancements to the protocol that will revolutionize the entire concept of Blockchain APIs, from pricing models to scaling and capabilities.